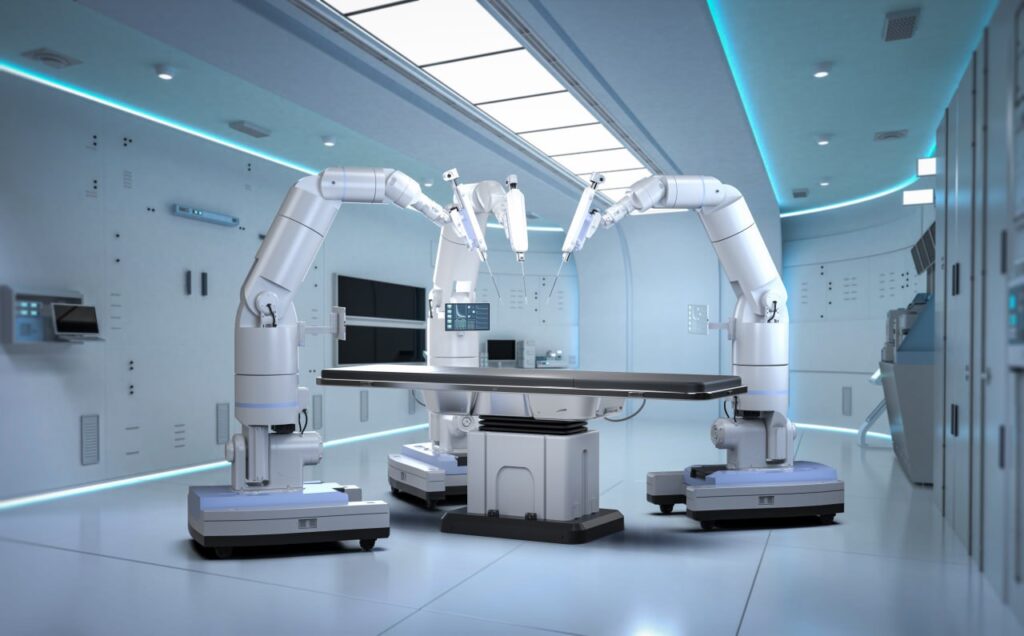

Industry: Surgical Robotics

About Company:

PROCEPT BioRobotics develops and commercializes the AquaBeam Robotic System, an image-guided, surgeon-controlled robotic device for treating benign prostatic hyperplasia (BPH) and other urologic conditions. The company is a commercial-stage medical device innovator focused on improving patient outcomes and reducing invasiveness in urologic surgery.

Company History:

- Founded: Listed publicly in September 2021 after IPO around $25/share.

- Since inception, PROCEPT has built a leading position in robotic urology by launching AquaBeam and scaling commercial adoption across U.S. and select international markets.

Company Advantage Over Competitors:

- First-mover with AquaBeam, offering minimally invasive robotic treatment specifically for BPH—a major unmet need among aging male populations.

- Strong institutional ownership: Approximately 84% of shares are owned by mutual funds, signaling confidence in strategic positioning and growth.

- Market momentum: Consistent early revenue growth (+55% in Q1 2025 year-over-year) positioning it ahead of peers in urologic robotics.

Risk Factors You May Want to Consider:

- No profitability yet: Although revenue is growing, the company remains unprofitable. EPS ratings remain weak, with modest composite rating from IBD.

- Device-market competition and adoption risk: Adoption by urologists and integration into surgical routines can be slow, and competition may arise from other robotics or laser-based therapies.

- Execution pressure: Scaling training, device placement, reimbursement negotiation, and capital expenditure for growth can stress resources. Lack of liquidity or capital raises could dilute.

- High volatility due to small-cap status: PRCT stock is more sensitive to trading swings, earnings reactions, and sentiment shifts given its relatively small market cap.

What Makes This Company Special or a Good Investment?

- Outstanding growth trajectory: Q1 2025 revenue reached $69.2M, up 55% year-over-year, led by U.S. segment growth (~$60.3M in revenue) and healthy commercial expansion.

- Strong analyst/composite momentum: Mixed EPS ratings but solid relative strength and technical breakout as per IBD, including a recent stock surge past a base buy point (~$52–54).

- Underpenetrated market: AquaBeam addresses modern surgical treatment of BPH, with significant room for scaling into urology suites, and potential to expand into other prostate and renal indications